The company currently owns 5 resistance mines, 2 Granite mines in Ninh Thuan, 3 white marble mines in Nghe An and especially CaCo3 quarry in Quy Hop.

This morning (August 21, 2017) at Ho Chi Minh Stock Exchange (HoSE), Crystal Plastic Manufacturing and Technology Joint Stock Company received the decision to list and celebrate the first trading day of the Company’s shares. on HoSE.

Accordingly, the company has a stock code of PLP with 15 million shares listed. Reference price on the first trading day is 12,000 dong / share. Thus, the market capitalization of PLP is about VND 180 billion.

PLP is the 425th company listed on HoSE. The official trading date is August 21, 2017 with the amplitude of fluctuation in the first trading day is ± 20% compared to the reference price.

After the listing, PLP shares saw a ceiling gain of VND 14,400 / share with the bid surplus of more than 1.7 million shares.

Crystal Plastic Precursor is Crystal Mineral Joint Stock Company, established in 2008. Starting from a business of exploiting and processing white stone in Quynh Hop, Nghe An, PLP has now developed into one of the enterprises. The first has a comprehensive business model from the exploitation of raw materials crushed CaCO3 stone for processing ultrafine CaCO3 powder to the finished product – CaCO3 resin Filler Masterbatch.

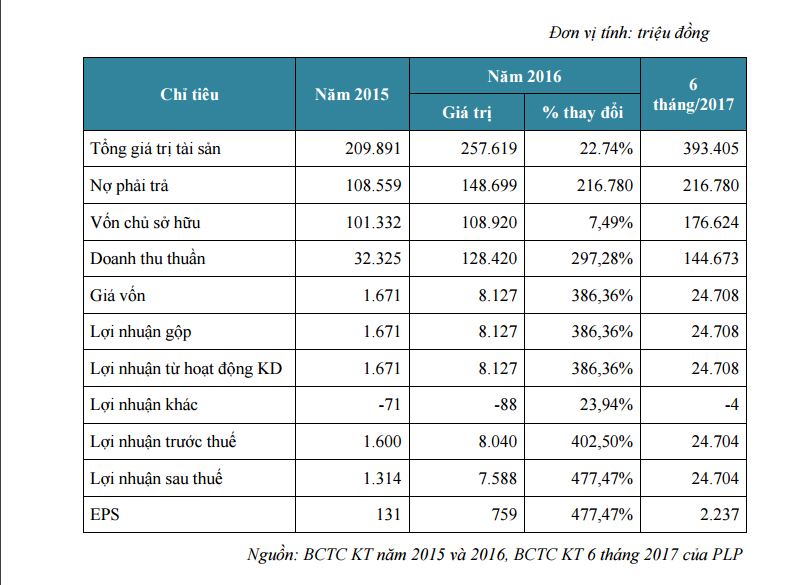

The company has a charter capital of VND 150 billion. In 2015, PLP completed the installation of a production line of 150,000 tons of CaCO3 ultrafine stone powder, and by the end of 2016 completed the installation and production of four Filler Masterbatch plastic production lines. Since then, 2016 Crystal Plastic’s revenue increased 4 times compared to 2015.

In the first 6 months of 2017, Crystal Plastic achieved a revenue of 146 billion higher than the revenue of 2016, thanks to the tax incentives, the profit before and after tax of the Company reached 24.5 billion.

The main business activities of the Company in recent years have been shifting from exploiting and selling raw material, CaCO3 stone, to producing the final product, Filler Masterbatch. Filler Masterbatch pellets cost 6 times higher than the price of stone powder products and even 10 times higher than traditional CaCO3 stone products, thus bringing a great source of revenue and profit to the Company.

Orientations in the coming years are very ambitious with both revenue and profit surging. In addition, Crystal Plastic products are mainly exported to markets such as the Americas, Europe, Australia, Asia … especially in China.

In European markets, Vietnamese products are not subject to anti-dumping tax of 8% – 30% like other Asian countries, typically China. Along with the specific imported input materials used to produce exports, the exchange rate risk of the Company has been significantly reduced.

In addition, the company’s Hai Phong factory is also enjoying preferential import tax and 0% VAT when importing raw materials used for export activities, thereby reducing the financial burden for the Company.

Mr. Duong Quang Thang – General Director of Pha Linh Plastic said that the plastic industry is one of the high growth industries in the world, an average of 9% / year over the past 50 years, particularly in Vietnam, the growth rate is 15% /year.

The company currently owns 5 resistance mines, 2 Granite mines in Ninh Thuan, 3 white marble mines in Nghe An and especially CaCo3 quarry in Quy Hop covering an area of over 10 hectares – one of the quarries. Marble has the best quality in the world in terms of brightness and whiteness.

According to Mr. Thang, after going on the floor, the Company will have many opportunities to cooperate as well as search for strategic partners. At the same time, in addition to promoting export activities which are advantages, the Company is also aiming to develop the domestic market.